In addition to electing town officials at the April 30 election, the ballot will include the following “override” question as to whether the town will be allowed to increase taxes beyond the limits of proposition 2 1/2.

Shall the Town of Acton be allowed to assess an additional $6.6 Million in real estate and personal property taxes for the purposes of funding the operating budget of the Public Schools and the Municipal Government for the fiscal year beginning July first 2024?

The budgets if the override passes are called the “A” budgets. These are the recommended budgets from the town and schools. The budgets if the override fails are called the “B” budgets. The differences between the “A” and “B” budgets are the effects of not passing the override.

The School Superintendent, Peter Light, has a video What’s in the A & B Budgets? that outlines the differences between the “A” and “B” budgets in the AB School District. John Mangiaratti, the Town Manager, presented the Revised FY 2025 “A” and “B” Budget and Capital Plan that contains details on the differences between the “A” and “B” municipal budgets.

In addition, the Finance Committee has several presentations and a video that explain the FY25 budget in detail:

- FinCom FY25 Point of View

- FinCom FY25 Override Educational

- FinCom March 26 Meeting video from Acton TV, which discusses the budget in detail.

The town intends to use $5.4M of the taxing authority in the 2025 fiscal year, beginning July 1, 2024. The effect on residents’ tax bills, depends on their house value. March 20, 2024 Town of Acton, Massachusetts Potential Tax Impacts of a $6.6M Override from the Town of Acton web site estimates the increase in tax bills, depending on whether the override passes or fails.

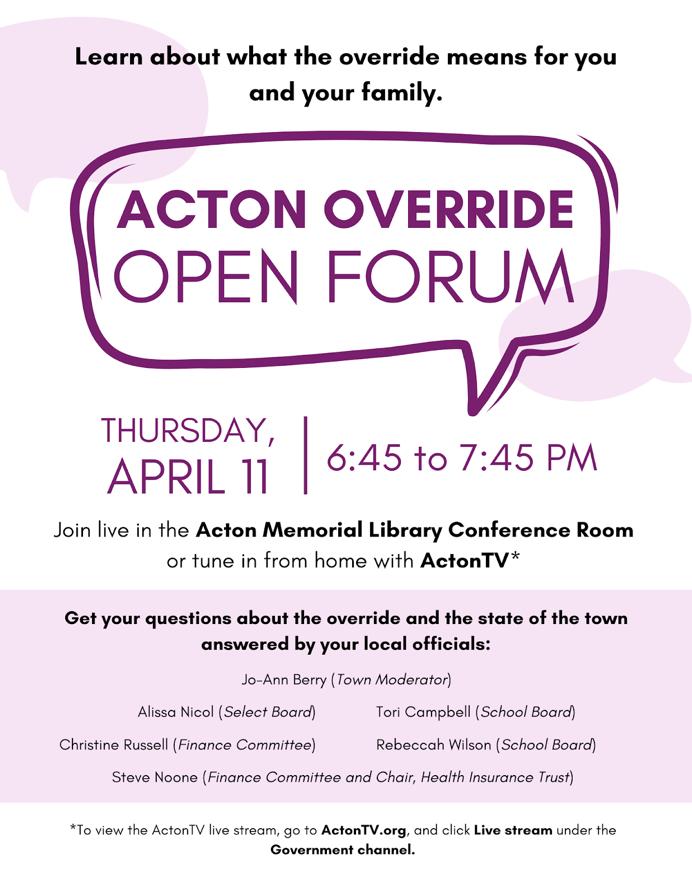

A non-partisan Acton Override Forum is scheduled for Thursday, April 11, 6:45 pm in the Acton Memorial Library downstairs conference room (and streaming on Acton TV).

The Acton Exchange will have more coverage of the override in the coming weeks.